How Trust, Transparency, and Digital Visibility Are Redefining Differentiation.

The New Reality

Once, performance alone could drive an investment manager’s growth, not anymore.

Today, brand strength, perceived credibility, and digital presence are as influential as returns. In an environment crowded with competition and defined by fee compression, product parity, and unprecedented transparency, firms that fail to manage how they are perceived risk being overlooked—no matter how well they perform.

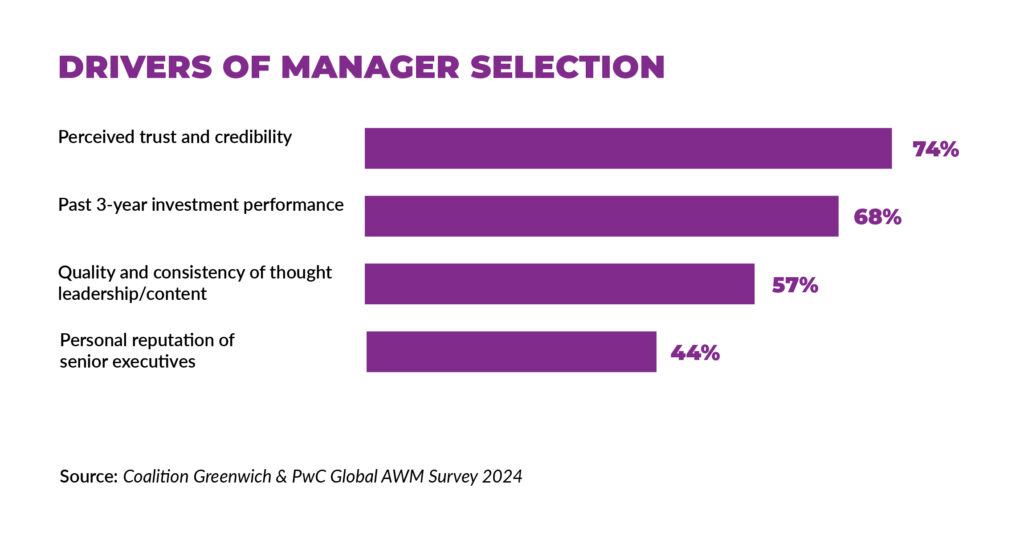

According to Coalition Greenwich and PwC’s 2024 institutional studies, nearly 80 percent of allocators now cite brand strength and reputation among the top factors driving manager selection, second only to proven performance. And Brunswick Group’s 2023 Digital Investor Survey found that 91 percent of investors have made a recommendation or decision based on a firm’s digital or social-media presence.

The message is clear: brand has become a measurable trust driver—and a competitive necessity.

Brand as a Strategic Trust Driver

Firms that treat brand as an asset class— managed and measured—gain both power and resilience. As one 2024 Coalition Greenwich study noted, managers with clearly articulated brands attract 2.5× greater inflows than peers with similar performance but lower name recognition.

Reputation compounds like capital—it must be earned in every search, scroll, and client interaction

The blurred lines between institutional, intermediary, and retail audiences mean investors now assess firms not just on strategy or results, but on the credibility of their story.

They want transparency, cultural alignment, and consistent communication—signals that reinforce reliability.

Due Diligence Begins Online

Due diligence no longer starts deep data dives or in-person meetings—it starts with smart search. Across the industry, digital reputation has become a proxy for institutional trust, in fact:

- 64% of website traffic to investment firms now originates from organic search.

- 92% of users click only on the first page of search results.

- Mobile accounts for more than 70% of all digital media time.

When investors or consultants type a firm’s name into Google, the first screen defines credibility. Managing that footprint—through thought leadership, earned media and consistent expert visibility—is no longer optional; it’s an imperative.

Institutional Investors Have Gone Social

Investor engagement has become increasingly digital—what once began with a conference introduction, or an industry roundtable now often starts online. Let’s take a look:

- Brunswick 2023 reports that 88 percent of investors consider it important for covered companies to maintain a social-media presence, and 91 percent have acted on digital content when forming investment opinions.

- LinkedIn remains the top platform for institutional engagement, with 85 percent of users logging in weekly to research firms, follow CIOs, and read market insights

- Investors also dedicate real attention: 63 percent spend 15–30 minutes reading a single piece of long-form content.

- Depth and substance still carry weight—especially when combined with clarity, authenticity, and expert perspective.

The Compounding Power of Differentiation and Perception

In asset management, true differentiation lies in credibility and trust—qualities that can’t be claimed, only demonstrated. Firms that articulate a clear purpose, communicate with consistency, and project expertise earn an advantage that performance alone can’t deliver.

While brand once followed performance; now it essentially precedes it. In a transparent marketplace, perception shapes discovery, engagement, and loyalty. The firms that lead with authenticity, evidence, and trust—and treat brand as an operating discipline, not facade—will define the next decade of growth.

At Crescendo Branding, we help asset management firms uncover and articulate what truly differentiates them—transforming complex expertise into clear, credible brand narratives and compliant communications that build trust and drive growth.

Sources: Brunswick Group Digital Investor Survey 2023; Coalition Greenwich Social Media Influencing Investment Decisions 2024; PwC Global Asset & Wealth Management Survey 2024; Edelman Trust Barometer 2025.